Kurs

+9,68%

Likviditet

17,5 MSEK

Kalender

| Est. tid* | ||

| 2026-05-18 | N/A | Årsstämma |

| 2026-04-24 | 07:50 | Kvartalsrapport 2026-Q1 |

| 2026-02-06 | 07:50 | Bokslutskommuniké 2025 |

| 2025-11-10 | - | X-dag halvårsutdelning DUNI 2.5 |

| 2025-10-24 | - | Kvartalsrapport 2025-Q3 |

| 2025-07-11 | - | Kvartalsrapport 2025-Q2 |

| 2025-05-20 | - | X-dag halvårsutdelning DUNI 2.5 |

| 2025-05-19 | - | Årsstämma |

| 2025-04-25 | - | Kvartalsrapport 2025-Q1 |

| 2025-02-11 | - | Bokslutskommuniké 2024 |

| 2024-11-11 | - | X-dag halvårsutdelning DUNI 2.5 |

| 2024-10-24 | - | Kvartalsrapport 2024-Q3 |

| 2024-07-12 | - | Kvartalsrapport 2024-Q2 |

| 2024-05-22 | - | X-dag halvårsutdelning DUNI 2.5 |

| 2024-05-21 | - | Årsstämma |

| 2024-04-24 | - | Kvartalsrapport 2024-Q1 |

| 2024-02-09 | - | Bokslutskommuniké 2023 |

| 2023-11-13 | - | X-dag halvårsutdelning DUNI 1.5 |

| 2023-10-24 | - | Kvartalsrapport 2023-Q3 |

| 2023-07-14 | - | Kvartalsrapport 2023-Q2 |

| 2023-05-17 | - | X-dag halvårsutdelning DUNI 1.5 |

| 2023-05-16 | - | Årsstämma |

| 2023-04-21 | - | Kvartalsrapport 2023-Q1 |

| 2023-02-14 | - | Bokslutskommuniké 2022 |

| 2022-10-27 | - | Kvartalsrapport 2022-Q3 |

| 2022-07-15 | - | Kvartalsrapport 2022-Q2 |

| 2022-05-19 | - | X-dag ordinarie utdelning DUNI 0.00 SEK |

| 2022-05-17 | - | Årsstämma |

| 2022-04-22 | - | Kvartalsrapport 2022-Q1 |

| 2022-02-17 | - | Bokslutskommuniké 2021 |

| 2021-10-21 | - | Kvartalsrapport 2021-Q3 |

| 2021-07-15 | - | Kvartalsrapport 2021-Q2 |

| 2021-05-05 | - | X-dag ordinarie utdelning DUNI 0.00 SEK |

| 2021-05-04 | - | Årsstämma |

| 2021-04-22 | - | Kvartalsrapport 2021-Q1 |

| 2021-02-12 | - | Bokslutskommuniké 2020 |

| 2020-11-16 | - | X-dag halvårsutdelning DUNI 0 |

| 2020-10-22 | - | Kvartalsrapport 2020-Q3 |

| 2020-07-15 | - | Kvartalsrapport 2020-Q2 |

| 2020-05-13 | - | X-dag halvårsutdelning DUNI 0 |

| 2020-05-12 | - | Årsstämma |

| 2020-04-24 | - | Kvartalsrapport 2020-Q1 |

| 2020-02-07 | - | Bokslutskommuniké 2019 |

| 2019-11-11 | - | X-dag halvårsutdelning DUNI 2.5 |

| 2019-10-18 | - | Kvartalsrapport 2019-Q3 |

| 2019-07-12 | - | Kvartalsrapport 2019-Q2 |

| 2019-05-08 | - | X-dag halvårsutdelning DUNI 2.5 |

| 2019-05-07 | - | Årsstämma |

| 2019-04-24 | - | Kvartalsrapport 2019-Q1 |

| 2019-02-14 | - | Bokslutskommuniké 2018 |

| 2018-10-18 | - | Kvartalsrapport 2018-Q3 |

| 2018-07-13 | - | Kvartalsrapport 2018-Q2 |

| 2018-05-09 | - | X-dag ordinarie utdelning DUNI 5.00 SEK |

| 2018-05-08 | - | Årsstämma |

| 2018-04-20 | - | Kvartalsrapport 2018-Q1 |

| 2018-02-09 | - | Bokslutskommuniké 2017 |

| 2017-10-20 | - | Kvartalsrapport 2017-Q3 |

| 2017-07-14 | - | Kvartalsrapport 2017-Q2 |

| 2017-05-04 | - | X-dag ordinarie utdelning DUNI 5.00 SEK |

| 2017-05-03 | - | Årsstämma |

| 2017-04-25 | - | Kvartalsrapport 2017-Q1 |

| 2017-02-10 | - | Bokslutskommuniké 2016 |

| 2016-10-21 | - | Kvartalsrapport 2016-Q3 |

| 2016-07-13 | - | Kvartalsrapport 2016-Q2 |

| 2016-05-04 | - | X-dag ordinarie utdelning DUNI 5.00 SEK |

| 2016-05-03 | - | Årsstämma |

| 2016-04-21 | - | Kvartalsrapport 2016-Q1 |

| 2016-02-12 | - | Bokslutskommuniké 2015 |

| 2015-10-21 | - | Kvartalsrapport 2015-Q3 |

| 2015-07-10 | - | Kvartalsrapport 2015-Q2 |

| 2015-05-06 | - | X-dag ordinarie utdelning DUNI 4.50 SEK |

| 2015-05-05 | - | Årsstämma |

| 2015-04-24 | - | Kvartalsrapport 2015-Q1 |

| 2015-02-13 | - | Bokslutskommuniké 2014 |

| 2014-10-22 | - | Analytiker möte 2014 |

| 2014-10-22 | - | Kvartalsrapport 2014-Q3 |

| 2014-07-11 | - | Kvartalsrapport 2014-Q2 |

| 2014-05-07 | - | X-dag ordinarie utdelning DUNI 4.00 SEK |

| 2014-05-06 | - | Årsstämma |

| 2014-04-25 | - | Kvartalsrapport 2014-Q1 |

| 2014-02-13 | - | Bokslutskommuniké 2013 |

| 2013-10-23 | - | Analytiker möte 2013 |

| 2013-10-23 | - | Kvartalsrapport 2013-Q3 |

| 2013-07-12 | - | Extra Bolagsstämma 2013 |

| 2013-07-12 | - | Kvartalsrapport 2013-Q2 |

| 2013-05-03 | - | X-dag ordinarie utdelning DUNI 3.50 SEK |

| 2013-05-02 | - | Årsstämma |

| 2013-04-19 | - | Kvartalsrapport 2013-Q1 |

| 2013-02-14 | - | Bokslutskommuniké 2012 |

| 2012-10-24 | - | Analytiker möte 2012 |

| 2012-10-24 | - | Kvartalsrapport 2012-Q3 |

| 2012-07-13 | - | Kvartalsrapport 2012-Q2 |

| 2012-05-04 | - | X-dag ordinarie utdelning DUNI 3.50 SEK |

| 2012-05-03 | - | Årsstämma |

| 2012-04-27 | - | Kvartalsrapport 2012-Q1 |

| 2012-02-15 | - | Bokslutskommuniké 2011 |

| 2012-01-20 | - | 15-7 2011 |

| 2011-10-26 | - | Kvartalsrapport 2011-Q3 |

| 2011-07-15 | - | Kvartalsrapport 2011-Q2 |

| 2011-05-06 | - | X-dag ordinarie utdelning DUNI 3.50 SEK |

| 2011-05-05 | - | Årsstämma |

| 2011-04-28 | - | Kvartalsrapport 2011-Q1 |

| 2011-02-15 | - | Bokslutskommuniké 2010 |

| 2010-10-27 | - | Kvartalsrapport 2010-Q3 |

| 2010-07-16 | - | Kvartalsrapport 2010-Q2 |

| 2010-05-06 | - | X-dag ordinarie utdelning DUNI 2.50 SEK |

| 2010-05-05 | - | Årsstämma |

| 2010-04-29 | - | Kvartalsrapport 2010-Q1 |

| 2010-02-17 | - | Bokslutskommuniké 2009 |

| 2009-10-28 | - | Kvartalsrapport 2009-Q3 |

| 2009-07-29 | - | Kvartalsrapport 2009-Q2 |

| 2009-05-07 | - | X-dag ordinarie utdelning DUNI 1.80 SEK |

| 2009-05-06 | - | Årsstämma |

| 2009-04-24 | - | Kvartalsrapport 2009-Q1 |

Beskrivning

| Land | Sverige |

|---|---|

| Lista | Mid Cap Stockholm |

| Sektor | Handel & varor |

| Industri | Dagligvaror |

Intresserad av bolagets nyckeltal?

Analysera bolaget i Börsdata!

Vem äger bolaget?

All ägardata du vill ha finns i Holdings!

Improved operating profit despite continued challenging market conditions

July 1 - September 30

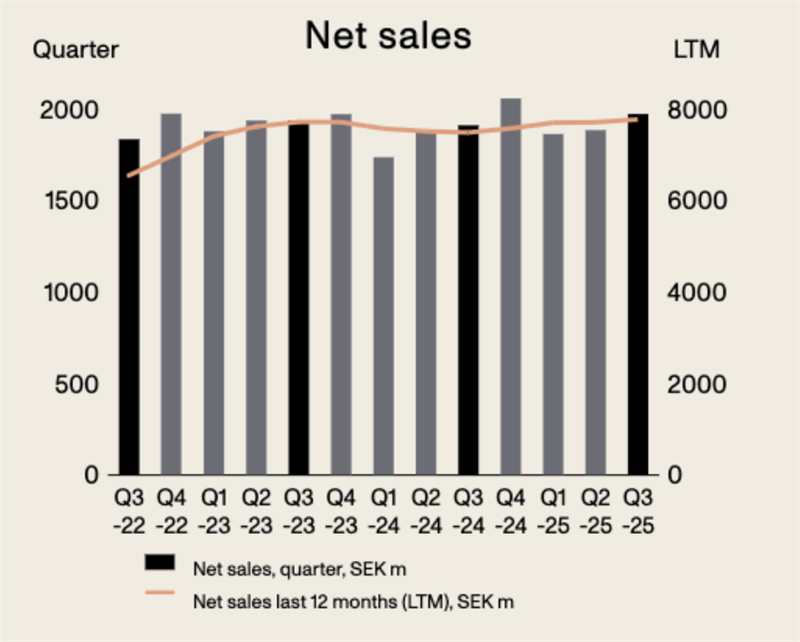

- Net sales amounted to SEK 1,972 m (1,910), corresponding to an increase of 3.3%. Adjusted for exchange rate movements, net sales increased by 7.9%, driven by acquisitions.

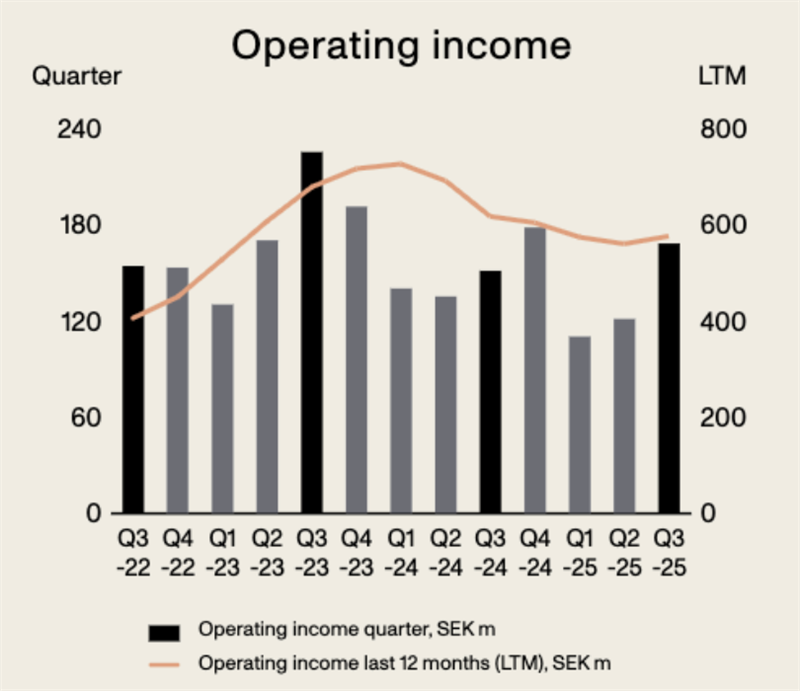

- Operating income amounted to SEK 168 m (151) and improved by just over 10% during the quarter, despite a market that remains challenging.

- Earnings per share attributable to equity holders of the Parent Company amounted to SEK 2.23 (-0.04).

- BioPak Group acquired Australia-based ByGreen during the quarter, with the aim of strengthening the offering in the field of sustainable single-use products.

- The Board of Directors has set new Group targets for 2026, with revised growth and dividend levels, as well as broadened sustainability targets.

| Key financials SEK m | 3 months Jul-Sep 2025 | 3 months Jul-Sep 2024 | 9 months Jan-Sep2025 | 9 months Jan-Sep2024 | 12 months Oct-Sep 2024/25 | 12 months Jan-Dec2024 |

| Net sales | 1,972 | 1,910 | 5,720 | 5,521 | 7,777 | 7,578 |

| Organic growth | -0.5% | -5.0% | -0.6% | -6.4% | -0.2% | -4.9% |

| Operating income1) | 168 | 151 | 398 | 426 | 576 | 604 |

| Operating margin1) | 8.5% | 7.9% | 7.0% | 7.7% | 7.4% | 8.0% |

| EBIT | 151 | 10 | 344 | 249 | 508 | 412 |

| EBIT margin | 7.7% | 0.5% | 6.0% | 4.5% | 6.5% | 5.4% |

| Income after financial items | 138 | -2 | 304 | 206 | 453 | 355 |

| Income after tax | 112 | 3 | 237 | 171 | 344 | 278 |

| Earnings per share attributable to equity holders of the Parent Company | 2.23 | -0.04 | 4.83 | 3.34 | 6.96 | 5.48 |

| Adjusted earnings per share attributable to equity holders of the Parent Company | 2.23 | 2.08 | 4.83 | 5.46 | 6.96 | 7.56 |

| Return on capital employed, excluding goodwill | 23.8% | 25.4% | 23.8% | 25.4% | 23.8% | 24.8% |

1) For reconciliation of alternative key financials, definition of key financials and glossary, see pages 28-29.

CEO summary

Despite a market that remains challenging, Duni Group's operating income improved by just over 10% in the third quarter. Previous acquisitions, efficiency improvements and good cost control all contributed to this positive trend.

In the third quarter, the Group's net sales increased by SEK 62 m to SEK 1,972 m (1,910), compared with the same period in the previous year. This corresponds to a 7.9% increase at fixed exchange rates. Operating income improved by just over 10% to SEK 168 m (151), primarily driven by increased cost efficiency in operating activities and contributions from acquired companies. Cost-saving initiatives implemented in the sales chain are also starting to show results, and are expected to achieve their full effect in Q4.

Demand in the European hotel and restaurant market remains weak and has not fully recovered from the pandemic. In Germany, for example, which is our biggest market, inflation-adjusted net sales in restaurants fell by 3.5% according to the latest statistics available. We are seeing few new establishments and an increased number of bankruptcies, with consequences that include increased price pressure in our product categories. As a result of the weak recovery, Germany has proposed a permanent reduction in VAT for restaurants from 19% to 7%, effective from January 1, 2026.

Dining Solutions: Growth through acquisitions and efficiency improvements

In Dining Solutions, net sales increased by SEK 119 m and amounted to SEK 1,221 m (1,102). At fixed exchange rates, this corresponds to a sales increase of 13.4%. Operating income improved to SEK 140 m (125), thanks to improved efficiency and good cost control. Previous acquisitions made a positive contribution - to both increased net sales and operating income. Despite continued intense competition, several major contracts were secured during the quarter, confirming the strength in our offering of cost-efficient, sustainable solutions. For the third consecutive quarter, sales to the restaurant sector in Germany continued to grow, in contrast to the general market landscape.

Food Packaging Solutions: Stabilization in Europe and the transition continues

Net sales for the quarter fell by SEK 57 m and amounted to SEK 751 m (808). At fixed exchange rates, this corresponds to a sales increase of 0.3%. There were signs of stabilization in Europe. But the trend varied within the product range, with Duniform® performing significantly better than the rest. Operating income amounted to SEK 27 m (27), in line with the previous year. During the quarter, BioPak Group completed an acquisition of the Australia-based company ByGreen, with the aim of enhancing the portfolio of sustainable single-use products.

Looking towards 2030: updated company targets for profitable and sustainable growth

We are now half way through our Decade of Action - a journey that sees us consciously building a stronger, more sustainable and more profitable company. The company targets that have guided us until 2025 will now be updated, in line with the Board's decision, to more clearly reflect our strategic direction going forward.

Our three financial targets will be adjusted to be better aligned with our strategy and business model. The growth target is being increased to 6% from the previous 5% and includes both organic development and acquisitions. The aim is that around half of annual sales growth will be organic. The dividend target is being increased from >40% to >50% of income after tax, while the operating margin target of >10% remains.

The sustainability targets are being broadened and more clearly anchored in the strategy. We are retaining our long-term ambitions for circularity and net zero emissions (e.g. Scope 1 & 2: -57% by 2030), but with an adjusted target for circularity (90% circular input materials). We are also adding targets for supplier responsibility (100% signing up to code of conduct) and occupational health and safety (<10 Loss Time Incidents "LTI"/1,000 employees).

The targets will come into force as of January 2026.

Positioned for recovery

After the pandemic, we and many others predicted a faster recovery than the one we have actually seen. At the same time, the weaker market situation has created a more favorable climate for acquisitions, restructuring and efficiency improvements. An opportunity that we have seized. We are now well-equipped to achieve our updated targets for 2030.

Robert Dackeskog,

President and CEO,

Duni Group

For additional information, please contact:

Magnus Carlsson, EVP Finance/CFO, +46 40-10 62 00, magnus.carlsson@duni.com

Amanda Larsson, Head of Communications, +46 76-608 33 08, amanda.larsson@duni.com

Duni AB (publ) Box 237

201 22 Malmö

Telefon: 040-10 62 00 www.dunigroup.se

Organisationsnummer: 556536-7488

Duni Group is a market leader in attractive, environmentally sound and functional products for table setting and take-away. The Group markets and sells its products under the brands Duni, BioPak, Paper+Design and Poppies, which are represented in more than 50 markets. Duni has around 2,800 employees spread out across 26 countries, with its headquarters in Malmö and production sites in Sweden, Slovenia, Germany, Poland, Thailand, and the UK. Duni is listed on the NASDAQ Stockholm under the ticker name "DUNI". Its ISIN code is SE0000616716.

This information is information that Duni AB is obligated to make public pursuant to the EU Market Abuse Regulation. The information was provided, through the agency of the contact person, for publication at 07:45 CET on October 24, 2025.