Kurs

-9,09%

Likviditet

2 526 MSEK

Kalender

| Est. tid* | ||

| 2026-10-21 | 07:00 | Kvartalsrapport 2026-Q3 |

| 2026-07-15 | 07:00 | Kvartalsrapport 2026-Q2 |

| 2026-04-22 | 07:00 | Kvartalsrapport 2026-Q1 |

| 2026-03-26 | N/A | X-dag bonusutdelning SHB B 9.5 |

| 2026-03-26 | N/A | X-dag ordinarie utdelning SHB B 8.00 SEK |

| 2026-03-26 | N/A | X-dag bonusutdelning SHB A 9.5 |

| 2026-03-26 | N/A | X-dag ordinarie utdelning SHB A 8.00 SEK |

| 2026-03-25 | N/A | Årsstämma |

| 2026-02-04 | - | Bokslutskommuniké 2025 |

| 2025-10-22 | - | Kvartalsrapport 2025-Q3 |

| 2025-07-16 | - | Kvartalsrapport 2025-Q2 |

| 2025-04-30 | - | Kvartalsrapport 2025-Q1 |

| 2025-03-27 | - | X-dag ordinarie utdelning SHB B 7.50 SEK |

| 2025-03-27 | - | X-dag bonusutdelning SHB A 7.5 |

| 2025-03-27 | - | X-dag bonusutdelning SHB B 7.5 |

| 2025-03-27 | - | X-dag ordinarie utdelning SHB A 7.50 SEK |

| 2025-03-26 | - | Årsstämma |

| 2025-02-05 | - | Bokslutskommuniké 2024 |

| 2024-10-23 | - | Kvartalsrapport 2024-Q3 |

| 2024-07-17 | - | Kvartalsrapport 2024-Q2 |

| 2024-04-24 | - | Kvartalsrapport 2024-Q1 |

| 2024-03-21 | - | X-dag ordinarie utdelning SHB B 6.50 SEK |

| 2024-03-21 | - | X-dag bonusutdelning SHB B 6.5 |

| 2024-03-21 | - | X-dag ordinarie utdelning SHB A 6.50 SEK |

| 2024-03-21 | - | X-dag bonusutdelning SHB A 6.5 |

| 2024-03-20 | - | Årsstämma |

| 2024-02-07 | - | Bokslutskommuniké 2023 |

| 2023-10-18 | - | Kvartalsrapport 2023-Q3 |

| 2023-07-19 | - | Kvartalsrapport 2023-Q2 |

| 2023-04-26 | - | Kvartalsrapport 2023-Q1 |

| 2023-03-23 | - | X-dag ordinarie utdelning SHB B 5.50 SEK |

| 2023-03-23 | - | X-dag bonusutdelning SHB A 2.5 |

| 2023-03-23 | - | X-dag ordinarie utdelning SHB A 5.50 SEK |

| 2023-03-23 | - | X-dag bonusutdelning SHB B 2.5 |

| 2023-03-22 | - | Årsstämma |

| 2023-02-08 | - | Bokslutskommuniké 2022 |

| 2022-10-19 | - | Kvartalsrapport 2022-Q3 |

| 2022-07-15 | - | Kvartalsrapport 2022-Q2 |

| 2022-04-27 | - | Kvartalsrapport 2022-Q1 |

| 2022-03-24 | - | X-dag ordinarie utdelning SHB B 5.00 SEK |

| 2022-03-24 | - | X-dag ordinarie utdelning SHB A 5.00 SEK |

| 2022-03-23 | - | Årsstämma |

| 2022-02-09 | - | Bokslutskommuniké 2021 |

| 2021-10-21 | - | Extra Bolagsstämma 2021 |

| 2021-10-19 | - | Kvartalsrapport 2021-Q3 |

| 2021-07-16 | - | Kvartalsrapport 2021-Q2 |

| 2021-04-21 | - | Kvartalsrapport 2021-Q1 |

| 2021-03-25 | - | X-dag ordinarie utdelning SHB B 4.10 SEK |

| 2021-03-25 | - | X-dag ordinarie utdelning SHB A 4.10 SEK |

| 2021-03-24 | - | Årsstämma |

| 2021-02-03 | - | Bokslutskommuniké 2020 |

| 2020-10-21 | - | Kvartalsrapport 2020-Q3 |

| 2020-07-15 | - | Kvartalsrapport 2020-Q2 |

| 2020-04-22 | - | Kvartalsrapport 2020-Q1 |

| 2020-03-26 | - | X-dag ordinarie utdelning SHB A 0.00 SEK |

| 2020-03-26 | - | X-dag ordinarie utdelning SHB B 0.00 SEK |

| 2020-03-25 | - | Årsstämma |

| 2020-02-05 | - | Bokslutskommuniké 2019 |

| 2019-10-23 | - | Kvartalsrapport 2019-Q3 |

| 2019-07-17 | - | Kvartalsrapport 2019-Q2 |

| 2019-04-17 | - | Kvartalsrapport 2019-Q1 |

| 2019-03-28 | - | X-dag ordinarie utdelning SHB B 5.50 SEK |

| 2019-03-28 | - | X-dag ordinarie utdelning SHB A 5.50 SEK |

| 2019-03-27 | - | Årsstämma |

| 2019-02-06 | - | Bokslutskommuniké 2018 |

| 2018-10-24 | - | Kvartalsrapport 2018-Q3 |

| 2018-07-18 | - | Kvartalsrapport 2018-Q2 |

| 2018-04-25 | - | Kvartalsrapport 2018-Q1 |

| 2018-03-22 | - | X-dag bonusutdelning SHB B 2 |

| 2018-03-22 | - | X-dag ordinarie utdelning SHB B 5.50 SEK |

| 2018-03-22 | - | X-dag bonusutdelning SHB A 2 |

| 2018-03-22 | - | X-dag ordinarie utdelning SHB A 5.50 SEK |

| 2018-03-21 | - | Årsstämma |

| 2018-02-07 | - | Bokslutskommuniké 2017 |

| 2017-10-18 | - | Kvartalsrapport 2017-Q3 |

| 2017-07-18 | - | Kvartalsrapport 2017-Q2 |

| 2017-04-26 | - | Kvartalsrapport 2017-Q1 |

| 2017-03-30 | - | X-dag ordinarie utdelning SHB A 5.00 SEK |

| 2017-03-30 | - | X-dag ordinarie utdelning SHB B 5.00 SEK |

| 2017-03-29 | - | Årsstämma |

| 2017-02-08 | - | Bokslutskommuniké 2016 |

| 2016-10-19 | - | Kvartalsrapport 2016-Q3 |

| 2016-07-15 | - | Kvartalsrapport 2016-Q2 |

| 2016-04-20 | - | Kvartalsrapport 2016-Q1 |

| 2016-03-17 | - | X-dag bonusutdelning SHB B 1.5 |

| 2016-03-17 | - | X-dag ordinarie utdelning SHB B 4.50 SEK |

| 2016-03-17 | - | X-dag bonusutdelning SHB A 1.5 |

| 2016-03-17 | - | X-dag ordinarie utdelning SHB A 4.50 SEK |

| 2016-03-16 | - | Årsstämma |

| 2016-02-09 | - | Bokslutskommuniké 2015 |

| 2015-10-21 | - | Kvartalsrapport 2015-Q3 |

| 2015-07-21 | - | Kvartalsrapport 2015-Q2 |

| 2015-05-19 | - | Split SHB B 1:3 |

| 2015-05-19 | - | Split SHB A 1:3 |

| 2015-04-29 | - | Kvartalsrapport 2015-Q1 |

| 2015-03-26 | - | X-dag bonusutdelning SHB B 5 |

| 2015-03-26 | - | X-dag ordinarie utdelning SHB B 12.50 SEK |

| 2015-03-26 | - | X-dag bonusutdelning SHB A 5 |

| 2015-03-26 | - | X-dag ordinarie utdelning SHB A 12.50 SEK |

| 2015-03-25 | - | Årsstämma |

| 2015-02-04 | - | Bokslutskommuniké 2014 |

| 2014-10-24 | - | Analytiker möte 2014 |

| 2014-10-22 | - | Kvartalsrapport 2014-Q3 |

| 2014-07-17 | - | Kvartalsrapport 2014-Q2 |

| 2014-04-30 | - | Kvartalsrapport 2014-Q1 |

| 2014-03-27 | - | X-dag bonusutdelning SHB B 5 |

| 2014-03-27 | - | X-dag ordinarie utdelning SHB B 11.50 SEK |

| 2014-03-27 | - | X-dag bonusutdelning SHB A 5 |

| 2014-03-27 | - | X-dag ordinarie utdelning SHB A 11.50 SEK |

| 2014-03-26 | - | Årsstämma |

| 2014-02-05 | - | Bokslutskommuniké 2013 |

| 2013-10-23 | - | Kvartalsrapport 2013-Q3 |

| 2013-07-17 | - | Analytiker möte 2013 |

| 2013-07-17 | - | Kvartalsrapport 2013-Q2 |

| 2013-04-24 | - | Kvartalsrapport 2013-Q1 |

| 2013-03-21 | - | X-dag ordinarie utdelning SHB B 10.75 SEK |

| 2013-03-21 | - | X-dag ordinarie utdelning SHB A 10.75 SEK |

| 2013-03-20 | - | Årsstämma |

| 2013-02-06 | - | Bokslutskommuniké 2012 |

| 2012-10-22 | - | Analytiker möte 2012 |

| 2012-10-22 | - | Kvartalsrapport 2012-Q3 |

| 2012-07-17 | - | Kvartalsrapport 2012-Q2 |

| 2012-04-26 | - | Kvartalsrapport 2012-Q1 |

| 2012-03-29 | - | X-dag ordinarie utdelning SHB B 9.75 SEK |

| 2012-03-29 | - | X-dag ordinarie utdelning SHB A 9.75 SEK |

| 2012-03-28 | - | Årsstämma |

| 2012-02-15 | - | Bokslutskommuniké 2011 |

| 2011-10-26 | - | Kvartalsrapport 2011-Q3 |

| 2011-07-20 | - | Kvartalsrapport 2011-Q2 |

| 2011-04-27 | - | Kvartalsrapport 2011-Q1 |

| 2011-03-24 | - | X-dag ordinarie utdelning SHB B 9.00 SEK |

| 2011-03-24 | - | X-dag ordinarie utdelning SHB A 9.00 SEK |

| 2011-03-23 | - | Årsstämma |

| 2011-03-15 | - | Kapitalmarknadsdag 2011 |

| 2011-02-09 | - | Bokslutskommuniké 2010 |

| 2010-10-20 | - | Kvartalsrapport 2010-Q3 |

| 2010-07-20 | - | Kvartalsrapport 2010-Q2 |

| 2010-04-30 | - | X-dag ordinarie utdelning SHB B 8.00 SEK |

| 2010-04-30 | - | X-dag ordinarie utdelning SHB A 8.00 SEK |

| 2010-04-29 | - | Årsstämma |

| 2010-04-28 | - | Kvartalsrapport 2010-Q1 |

| 2010-02-18 | - | Bokslutskommuniké 2009 |

| 2009-10-28 | - | Kvartalsrapport 2009-Q3 |

| 2009-07-21 | - | Kvartalsrapport 2009-Q2 |

| 2009-04-30 | - | X-dag ordinarie utdelning SHB B 7.00 SEK |

| 2009-04-30 | - | X-dag ordinarie utdelning SHB A 7.00 SEK |

| 2009-04-29 | - | Årsstämma |

| 2009-04-28 | - | Kvartalsrapport 2009-Q1 |

| 2008-04-24 | - | X-dag bonusutdelning SHB B 5 |

| 2008-04-24 | - | X-dag ordinarie utdelning SHB B 8.50 SEK |

| 2008-04-24 | - | X-dag bonusutdelning SHB A 5 |

| 2008-04-24 | - | X-dag ordinarie utdelning SHB A 8.50 SEK |

| 2007-04-25 | - | X-dag ordinarie utdelning SHB B 8.00 SEK |

| 2007-04-25 | - | X-dag ordinarie utdelning SHB A 8.00 SEK |

| 2006-04-26 | - | X-dag ordinarie utdelning SHB B 7.00 SEK |

| 2006-04-26 | - | X-dag ordinarie utdelning SHB A 7.00 SEK |

| 2005-04-27 | - | X-dag ordinarie utdelning SHB B 6.00 SEK |

| 2005-04-27 | - | X-dag ordinarie utdelning SHB A 6.00 SEK |

| 2004-04-28 | - | X-dag ordinarie utdelning SHB B 5.25 SEK |

| 2004-04-28 | - | X-dag ordinarie utdelning SHB A 5.25 SEK |

| 2003-04-30 | - | X-dag ordinarie utdelning SHB A 4.75 SEK |

| 2003-04-30 | - | X-dag ordinarie utdelning SHB B 4.75 SEK |

| 2002-04-24 | - | X-dag ordinarie utdelning SHB B 4.50 SEK |

| 2002-04-24 | - | X-dag ordinarie utdelning SHB A 4.50 SEK |

| 2001-04-25 | - | X-dag ordinarie utdelning SHB B 4.00 SEK |

| 2001-04-25 | - | X-dag ordinarie utdelning SHB A 4.00 SEK |

| 2000-04-17 | - | X-dag ordinarie utdelning SHB B 3.00 SEK |

| 2000-04-17 | - | X-dag ordinarie utdelning SHB A 3.00 SEK |

| 1999-06-09 | - | Split SHB B 1:3 |

| 1999-06-09 | - | Split SHB A 1:3 |

| 1999-04-28 | - | X-dag ordinarie utdelning SHB B 8.00 SEK |

| 1999-04-28 | - | X-dag ordinarie utdelning SHB A 8.00 SEK |

| 1998-04-29 | - | X-dag ordinarie utdelning SHB B 6.50 SEK |

| 1998-04-29 | - | X-dag ordinarie utdelning SHB A 6.50 SEK |

| 1997-04-23 | - | X-dag ordinarie utdelning SHB B 5.00 SEK |

| 1997-04-23 | - | X-dag ordinarie utdelning SHB A 5.00 SEK |

| 1996-04-24 | - | X-dag ordinarie utdelning SHB B 3.75 SEK |

| 1996-04-24 | - | X-dag ordinarie utdelning SHB A 3.75 SEK |

| 1995-04-27 | - | X-dag ordinarie utdelning SHB B 3.00 SEK |

| 1995-04-27 | - | X-dag ordinarie utdelning SHB A 3.00 SEK |

| 1987-08-26 | - | Split SHB A 1:2 |

Beskrivning

| Land | Sverige |

|---|---|

| Lista | Large Cap Stockholm |

| Sektor | Finans |

| Industri | Storbank |

Intresserad av bolagets nyckeltal?

Analysera bolaget i Börsdata!

Vem äger bolaget?

All ägardata du vill ha finns i Holdings!

Q2 2025

(Q1 2025)

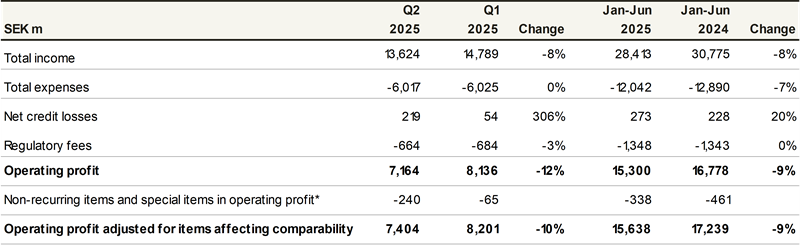

- Operating profit was SEK 7,164m (8,136).

- Return on equity was 12.7% (12.9).

- Earnings per share amounted to SEK 2.77 (3.19).

- The C/I ratio was 44.2% (40.7).

- The credit loss ratio was -0.03% (-0.01).

- The common equity tier 1 ratio was 18.4% (18.4).

January - June 2025

(January - June 2024)

- Operating profit was SEK 15,300m (16,778).

- Return on equity was 12.8% (14.4).

- Earnings per share amounted to SEK 5.96 (6.77).

- The C/I ratio was 42.4% (41.9).

- The credit loss ratio was -0.02% (-0.01).

- The common equity tier 1 ratio was 18.4% (18.9).

Stable profitability

Lending volumes increased in all home markets, albeit to a limited extent. At the same time, net interest income was held back by the significant appreciation of the Swedish krona, as well as by the fact that previous positive repricing effects between deposits and lending were not repeated during the quarter. Net fee and commission income was resilient and relatively unchanged compared with the previous quarter, in spite of the effects on assets under management from lower stock markets. Underlying expenses continued to decrease, and credit losses consisted of net reversals for a sixth consecutive quarter. All in all, return on equity was stable compared with the previous quarter.

Lower underlying expenses and improved efficiency

Execution on efficiency improvement work has contributed to a lower expense level in the Bank. Compared with both the first six months and the second quarter of the previous year, expenses decreased by 5% adjusted for Oktogonen and restructuring charges. This was achieved in spite of general cost inflation and the inclusion of salary adjustments for the year. The work to reduce expenses and improve efficiency across the Bank has mainly been concentrated to central departments and business support units. The implemented measures have resulted in a lower head count among both employees and external resources, and an increased expense and efficiency focus - within all units - has also contributed to an improved cost base.

A position of financial strength

The Bank's low credit risk is complemented by low funding and liquidity risk, a substantial liquidity reserve and strong capital situation. After anticipated dividend, the common equity tier 1 ratio amounted to 18.4%, corresponding to 3.5 percentage points over the regulatory requirement and thus 0.5 percentage points over the Bank's long-term target range of 1-3 percentage points above regulatory requirement. During the first half of the year, anticipated dividend amounted to SEK 7.15 per share, equivalent to 120% of profit for the period. The Bank's credit ratings by the leading rating agencies remained the highest overall among peer banks globally.

Information regarding the press conference and telephone conference

A press conference will be held on 16 juli 2025 at 09:30 a.m.

Press releases, presentations, a fact book and a recording of the press conference will be available at handelsbanken.com/ir.

For further information, please contact:

Michael Green, President and Chief Executive Officer

Tel: +46 (0)8 22 92 20

Carl Cederschiöld, CFO

Tel: +46 (0)8 22 92 20

Peter Grabe, Head of Investor Relations

Tel: +46 (0)70 559 11 67, peter.grabe@handelsbanken.se

This information is of the type that Svenska Handelsbanken AB is obliged to make public pursuant to the EU Market Abuse Regulation and the Swedish Securities Markets Act. The information was submitted for publication through the agency of the contact person set out above, at 07:00 a.m. CET on 16 July 2025.

For more information about Handelsbanken, please go to: handelsbanken.com