Bifogade filer

Prenumeration

Beskrivning

| Land | Sverige |

|---|---|

| Lista | Mid Cap Stockholm |

| Sektor | Finans |

| Industri | Övriga finansiella tjänster |

Intresserad av bolagets nyckeltal?

Analysera bolaget i Börsdata!

Vem äger bolaget?

All ägardata du vill ha finns i Holdings!

Millions of consumers across Europe are losing sight of their monthly spending and household outgoings, as almost half (45%) of consumers admit to being taken by surprise by how much their subscription fees build up without them realising. This is according to the 2023 European Consumer Payment Report from Intrum, the credit management services provider.

As inflation outpaces wage growth, consumers find themselves with considerably less money in their pocket. Three in four (76%) admit to just breaking even or over-spending each month. Subscription based services, that allow consumers to spread the cost of goods and services, while convenient are adding fuel to the fire causing ‘Subscription creep’ – as the build-up monthly payments for online purchases make it harder to cope with cost-of-living pressures.

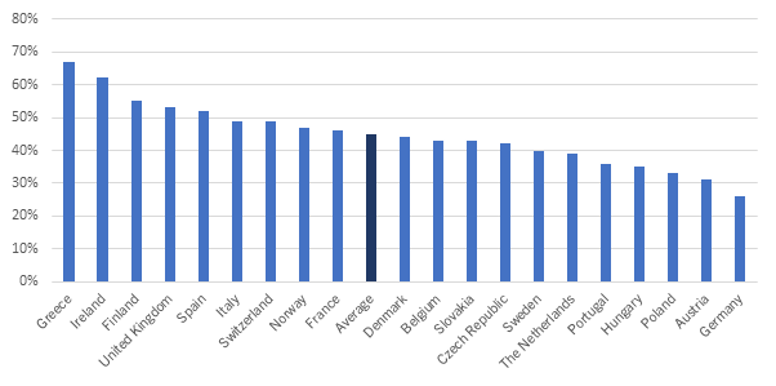

Published today, Intrum's annual study lays bare the experiences of 20,000 consumers across 20 European countries. It shows that modern payment methods for goods and services add to the challenge of managing money at a time of high inflation and rising interest rates. Greece (67%) is worst affected nation for ‘subscription creep’, followed by Ireland (62%), Finland (55%) and UK (53%).

Chart 1: European countries where consumers are most affected by ‘subscription creep’

Young adults most exposed to ‘subscription creep’

Intrum’s study shows that younger adults (Millennials, born 1980 onwards) are especially prone to experiencing ‘subscription creep’ compared with older generations. Across Europe, over half (52%) of Millennials and 53% of Gen Z admit they struggle to keep track of subscription spending, compared with just one in three (34%) Baby boomers.

Build-up of buy-now-pay-later commitments piles on the pressure

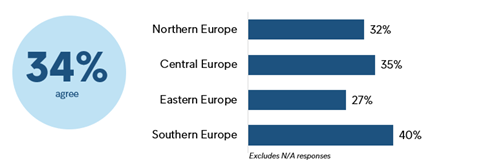

In another sign of increasingly complex personal finances, nearly one in three (30%) consumers across Europe say they are likely to increase their use of Buy Now, Pay Later (BNPL) arrangements to manage the impact of high interest rates and inflation. Almost half (47%) are more likely to spend money with businesses that offer them flexible payment terms including such as partial payments, multiple payment methods and flexible due dates.

Chart 2: To manage the impact of high interest rates and inflation, how likely are you to increase usage of buy-now/pay-later solutions?

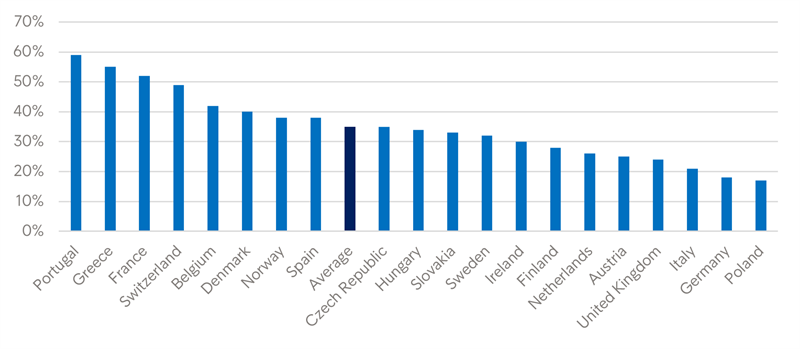

This is despite more than one in three consumers (35%) admitting they find it difficult to keep track of BNPL purchases and how their spending can build up to during the month. Younger generations are again the most affected, although almost three in ten (29%) of over-65s across Europe also find themselves struggling to manage their BNPL commitments.

Chart 3: Europeans finding it difficult to keep track of buy-now/pay-later purchases and how much they can build up during the month

The findings come at a time when half of European consumers (49%) say they have less spending money after paying for essential items and bills than a year ago. Three in four (76%) are only just breaking even or over-spending each month, with the average over-spender exceeding their budget by €232.

Denmark and Switzerland are at the more extreme end of the scale, with consumers in both countries exceeding their monthly budgets on average by more than €300 per month.

With their personal finances under pressure, more than one in three (35%) consumers admit they have failed to pay at least one bill on time in the last 12 months. This is the highest proportion in Intrum’s annual study since 2019.

| Year | Percentage of European consumers that have skipped at least one bill in the last 12 months |

| 2019 | 33% |

| 2020 | 29% |

| 2021 | 30% |

| 2022 | 29% |

| 2023 | 35% |

Many consumers’ resilience is hanging by a thread because they lack any ‘cash buffer’ to cover unexpected costs. One in five (20%) admit they have no savings to fall back on, and a further 17% have less than one month’s income saved.

Andres Rubio, President and CEO of Intrum, comments: “Manging your money effectively is about much more than understanding inflation and interest rates. Keeping track of your recurring subscription costs, payment deferrals and all debts is an increasingly complex but essential task. Millions of consumers are overspending each month or having to prioritise certain bills and often falling short and missing other payments.

While popular payment plans such as buy-now-pay-later enable a simplified shopping experience and can ease short-term pressure, we need to be aware that a growing number of consumers are using these methods to pay for daily essentials to manage the everyday cost of living. It is vital that everyone understands the terms, conditions and potential risks associated with credit products, especially if they are turning to them as a response to economic challenges.

For businesses, it’s important to adapt and demonstrate understanding of the challenges consumers are facing. Introducing more flexible payment terms and working with customers to find solutions that avoid long-term stress is essential. Flexible payment terms are clearly attractive to consumers, but using these responsibly is the key to long-term, sustainable spending patterns and customer relationships. Being there for consumers in the short term gives businesses the best chance of winning their loyalty once current economic pressures start to ease.”

ENDS

Notes to Editors

‘Subscription creep’ refers to the slow and continuous accumulation of multiple subscriptions, which can leave people exposed to rising costs and unsighted on their overall spending commitments.

About The European Consumer Payment Report 2023

The European Consumer Payment Report 2023 provides insight into European consumers’ everyday lives, their spending and ability to manage their household finances on a monthly basis. The report is based on an external survey conducted by FT Longitude across 20 countries in Europe. A total of 20,000 consumers participated in the 2023 edition of the survey. The fieldwork for the study was conducted between 19th July and the 1st September 2023.

For further information, please contact:

Kristin Andersson, Global Media Relations & Public Affairs Director

+46 70 585 78 18

kristin.andersson@intrum.com