Bifogade filer

Kurs

-1,41%

Likviditet

25,8 MSEK

Prenumeration

Kalender

| Est. tid* | ||

| 2026-10-23 | 07:00 | Kvartalsrapport 2026-Q3 |

| 2026-07-23 | 07:00 | Kvartalsrapport 2026-Q2 |

| 2026-05-07 | 07:00 | Kvartalsrapport 2026-Q1 |

| 2026-04-23 | N/A | X-dag ordinarie utdelning INTRUM 0.00 SEK |

| 2026-04-22 | N/A | Årsstämma |

| 2026-01-29 | - | Bokslutskommuniké 2025 |

| 2025-10-30 | - | Kvartalsrapport 2025-Q3 |

| 2025-10-10 | - | Extra Bolagsstämma 2025 |

| 2025-07-25 | - | Kvartalsrapport 2025-Q2 |

| 2025-06-10 | - | Årsstämma |

| 2025-05-30 | - | X-dag ordinarie utdelning INTRUM 0.00 SEK |

| 2025-05-07 | - | Kvartalsrapport 2025-Q1 |

| 2025-01-30 | - | Bokslutskommuniké 2024 |

| 2024-10-23 | - | Kvartalsrapport 2024-Q3 |

| 2024-07-18 | - | Kvartalsrapport 2024-Q2 |

| 2024-04-25 | - | X-dag ordinarie utdelning INTRUM 0.00 SEK |

| 2024-04-24 | - | Årsstämma |

| 2024-04-24 | - | Kvartalsrapport 2024-Q1 |

| 2024-01-25 | - | Bokslutskommuniké 2023 |

| 2023-10-31 | - | X-dag halvårsutdelning INTRUM 6.75 |

| 2023-10-25 | - | Kvartalsrapport 2023-Q3 |

| 2023-07-20 | - | Kvartalsrapport 2023-Q2 |

| 2023-04-28 | - | X-dag halvårsutdelning INTRUM 6.75 |

| 2023-04-27 | - | Årsstämma |

| 2023-04-27 | - | Kvartalsrapport 2023-Q1 |

| 2023-01-26 | - | Bokslutskommuniké 2022 |

| 2022-10-27 | - | Kvartalsrapport 2022-Q3 |

| 2022-07-21 | - | Kvartalsrapport 2022-Q2 |

| 2022-05-02 | - | X-dag ordinarie utdelning INTRUM 13.50 SEK |

| 2022-04-29 | - | Årsstämma |

| 2022-04-29 | - | Kvartalsrapport 2022-Q1 |

| 2022-01-27 | - | Bokslutskommuniké 2021 |

| 2021-10-21 | - | Kvartalsrapport 2021-Q3 |

| 2021-07-22 | - | Kvartalsrapport 2021-Q2 |

| 2021-04-30 | - | X-dag ordinarie utdelning INTRUM 12.00 SEK |

| 2021-04-29 | - | Årsstämma |

| 2021-04-29 | - | Kvartalsrapport 2021-Q1 |

| 2021-01-28 | - | Bokslutskommuniké 2020 |

| 2020-10-23 | - | Kvartalsrapport 2020-Q3 |

| 2020-07-23 | - | Kvartalsrapport 2020-Q2 |

| 2020-05-07 | - | X-dag ordinarie utdelning INTRUM 11.00 SEK |

| 2020-05-06 | - | Årsstämma |

| 2020-05-06 | - | Kvartalsrapport 2020-Q1 |

| 2020-02-04 | - | Bokslutskommuniké 2019 |

| 2019-10-23 | - | Kvartalsrapport 2019-Q3 |

| 2019-07-18 | - | Kvartalsrapport 2019-Q2 |

| 2019-04-29 | - | X-dag ordinarie utdelning INTRUM 9.50 SEK |

| 2019-04-26 | - | Årsstämma |

| 2019-04-26 | - | Kvartalsrapport 2019-Q1 |

| 2019-01-30 | - | Bokslutskommuniké 2018 |

| 2018-10-26 | - | Kvartalsrapport 2018-Q3 |

| 2018-07-24 | - | Kvartalsrapport 2018-Q2 |

| 2018-04-30 | - | X-dag ordinarie utdelning INTRUM 9.50 SEK |

| 2018-04-27 | - | Årsstämma |

| 2018-04-27 | - | Kvartalsrapport 2018-Q1 |

| 2018-01-31 | - | Bokslutskommuniké 2017 |

| 2017-10-18 | - | Kvartalsrapport 2017-Q3 |

| 2017-07-25 | - | Kvartalsrapport 2017-Q2 |

| 2017-06-30 | - | X-dag ordinarie utdelning INTRUM 9.00 SEK |

| 2017-06-29 | - | Årsstämma |

| 2017-04-25 | - | Kvartalsrapport 2017-Q1 |

| 2017-01-26 | - | Bokslutskommuniké 2016 |

| 2016-12-14 | - | Extra Bolagsstämma 2016 |

| 2016-10-19 | - | Kvartalsrapport 2016-Q3 |

| 2016-07-19 | - | Kvartalsrapport 2016-Q2 |

| 2016-04-21 | - | X-dag ordinarie utdelning INTRUM 8.25 SEK |

| 2016-04-20 | - | Årsstämma |

| 2016-04-20 | - | Kvartalsrapport 2016-Q1 |

| 2016-01-28 | - | Bokslutskommuniké 2015 |

| 2015-10-21 | - | Kvartalsrapport 2015-Q3 |

| 2015-07-16 | - | Kvartalsrapport 2015-Q2 |

| 2015-04-23 | - | X-dag ordinarie utdelning INTRUM 7.00 SEK |

| 2015-04-22 | - | Årsstämma |

| 2015-04-22 | - | Kvartalsrapport 2015-Q1 |

| 2015-01-29 | - | Bokslutskommuniké 2014 |

| 2014-10-22 | - | Analytiker möte 2014 |

| 2014-10-22 | - | Kvartalsrapport 2014-Q3 |

| 2014-07-17 | - | Kvartalsrapport 2014-Q2 |

| 2014-04-24 | - | X-dag ordinarie utdelning INTRUM 5.75 SEK |

| 2014-04-23 | - | Årsstämma |

| 2014-04-23 | - | Kvartalsrapport 2014-Q1 |

| 2014-02-05 | - | Bokslutskommuniké 2013 |

| 2013-10-24 | - | Analytiker möte 2013 |

| 2013-10-24 | - | Kvartalsrapport 2013-Q3 |

| 2013-07-19 | - | Kvartalsrapport 2013-Q2 |

| 2013-04-25 | - | X-dag ordinarie utdelning INTRUM 5.00 SEK |

| 2013-04-24 | - | Årsstämma |

| 2013-04-24 | - | Kvartalsrapport 2013-Q1 |

| 2013-03-21 | - | Kapitalmarknadsdag 2013 |

| 2013-02-05 | - | Bokslutskommuniké 2012 |

| 2012-10-24 | - | Analytiker möte 2012 |

| 2012-10-24 | - | Kvartalsrapport 2012-Q3 |

| 2012-07-20 | - | Kvartalsrapport 2012-Q2 |

| 2012-04-26 | - | X-dag ordinarie utdelning INTRUM 4.50 SEK |

| 2012-04-25 | - | Årsstämma |

| 2012-04-25 | - | Kvartalsrapport 2012-Q1 |

| 2012-02-08 | - | Bokslutskommuniké 2011 |

| 2011-10-26 | - | Kvartalsrapport 2011-Q3 |

| 2011-07-18 | - | Kvartalsrapport 2011-Q2 |

| 2011-05-03 | - | Kvartalsrapport 2011-Q1 |

| 2011-04-01 | - | X-dag ordinarie utdelning INTRUM 4.10 SEK |

| 2011-03-31 | - | Årsstämma |

| 2011-02-09 | - | Bokslutskommuniké 2010 |

| 2010-10-26 | - | Kvartalsrapport 2010-Q3 |

| 2010-07-19 | - | Kvartalsrapport 2010-Q2 |

| 2010-04-22 | - | Kvartalsrapport 2010-Q1 |

| 2010-03-26 | - | X-dag ordinarie utdelning INTRUM 3.75 SEK |

| 2010-03-25 | - | Årsstämma |

| 2010-02-03 | - | Bokslutskommuniké 2009 |

| 2009-10-22 | - | Kvartalsrapport 2009-Q3 |

| 2009-07-20 | - | Kvartalsrapport 2009-Q2 |

| 2009-04-28 | - | Kvartalsrapport 2009-Q1 |

| 2009-04-17 | - | X-dag ordinarie utdelning INTRUM 3.50 SEK |

| 2009-04-16 | - | Årsstämma |

Beskrivning

| Land | Sverige |

|---|---|

| Lista | Mid Cap Stockholm |

| Sektor | Finans |

| Industri | Övriga finansiella tjänster |

Intresserad av bolagets nyckeltal?

Analysera bolaget i Börsdata!

Vem äger bolaget?

All ägardata du vill ha finns i Holdings!

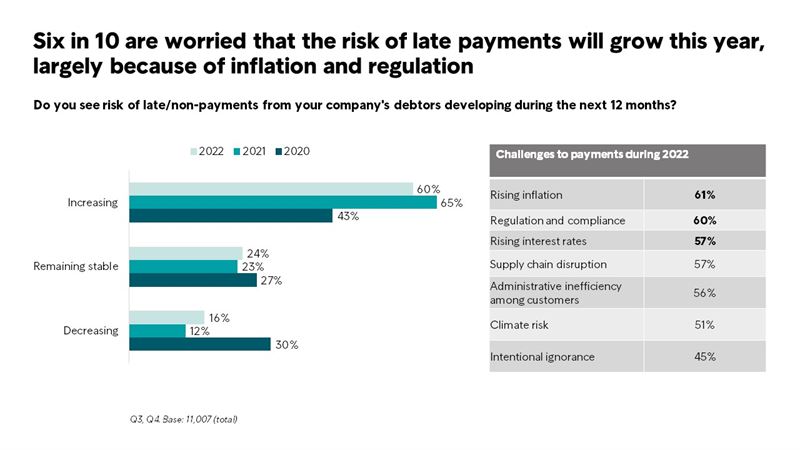

The 24th edition of the EPR, published today, clearly illustrates the multi-faceted challenges that Europeans businesses are set to manage.

“Europe is going through an eventful and challenging period. Today, companies face unprecedented disruption and uncertainty, adding to the pressure on businesses that still seek to recover from the Covid years. Against a backdrop of inflation, increasing interest rates and regulation, companies are expecting a jump in late payments as well as raised barriers to growth during the remainder of 2022. Securing a sound cash flow is a top priority for a majority of the surveyed businesses”, says Anders Engdahl, President & CEO of Intrum.

Key finding 1: Inflation and interest rates are creating challenges

Across Europe, growth is slowing down while supply-chain disruption, and soaring energy costs drive inflation at a rate not seen for decades.

- 6 in 10 companies are worried that the risk of late payments will grow this year, largely because of inflation, increased regulation and rising interest rates.

- A majority of European businesses (58%) admit they lack experience of how to manage inflation and more than half say it is preventing them from growing the business (51%), meeting wage demands (55%), and paying suppliers on time (58%).

- 6 in 10 businesses are becoming more cautious with their borrowing and spending plans, as they expect interest rates to rise more than once during the next 12 months.

“Concerns are rising across Europe as inflation is accelerating and growth is flattening. If this trend is not broken, we could be facing a period of stagflation; contracting economic output combined with high inflation. On a positive note, labor markets across Europe have continued to strengthen this year, although low unemployment rates could lead to further upwards pressure on wages ”, says Anna Zabrodzka-Averianov, Senior Economist at Intrum.

Key finding 2: Businesses expect their cash flow to suffer but lack the agility and expertise to manage the impact

Liquidity, cash flow and credit risk management make up the main strategic priorities, as companies seek to secure a solid financial position.

- 8 in 10 European companies state that strengthened liquidity and cash flow is a strategic priority for the year. A similar share mention improving debt management as well as credit risk management as top priorities.

- Half of the surveyed businesses report that they are weaker now than before the outbreak of the pandemic. At the same time, 6 in 10 say that the pandemic has motivated them to becoming better in managing risks related to late payments.

- 53 per cent of respondents say they would like to improve their management of late payments but find this difficult due to a lack of skills and resources in-house.

Key finding 3: Year on year, businesses increasingly see late payments as a significant barrier to growth

Late payments are hindering the growth of companies across European countries, hampering the economic and social development of the economy at large.

- 4 in 10 companies say that late payments are prohibiting growth of the company.

- 2 in 3 businesses say faster payments from their customers would help them expand their product and service operations, whereas 1 in 2 say it would help them grow by hiring more employees.

- Businesses are – at last – hopeful that the pandemic is coming to an end. Approaching 2 in 3 (64 per cent) believe Covid-19 will stop having an impact on their country within a year, creating new opportunities for growth.

About the survey

The European Payment Report describes the impact of late payments on businesses’ outlook, growth, and development. The report is based on a survey conducted simultaneously by Longitude in 29 European countries between 17 January and 13 April 2022. In total, 11,007 small, medium and large companies across 15 industry sectors participated in the research.

For further information, please contact:

Anna Fall, Chief Brand & Communications Officer

+46 (0)709 96 98 21

anna.fall@intrum.com

Intrum is the industry-leading provider of credit management services across 24 markets in Europe. By helping companies to get paid and support people with their late payments, Intrum leads the way to a sound economy and plays a critical role in society at large. Intrum has circa 10,000 dedicated professionals who serve around 80,000 companies across Europe. In 2021, revenues amounted to SEK 17.8 billion. Intrum is headquartered in Stockholm, Sweden and publicly listed on the Nasdaq Stockholm exchange. For further information, please visit www.intrum.com.