Beskrivning

| Land | Schweiz |

|---|---|

| Lista | First North Stockholm |

| Sektor | Informationsteknik |

| Industri | Infrastruktur |

Intresserad av bolagets nyckeltal?

Analysera bolaget i Börsdata!

Vem äger bolaget?

All ägardata du vill ha finns i Holdings!

Jan 1st - Dec 31st 2024

■ Net sales amounted to EUR 15 782 thousand (EUR 15 607 thousand in 2023), representing a modest increase of 1.1 percent

■ EBITDA of EUR 1 702 thousand (1 980) and EBITDA margin of 10.8 percent (12.7), reflecting a decline in operational efficiency

■ EBIT of EUR 1 527 thousand (1 806) and EBIT margin of 9.7 percent (11.6), showing continued profitability albeit at reduced levels

■ Net earnings after tax of EUR 605 thousand (788) and EAT margin of 3.8 percent (5.0), indicating compressed net profitability

Important events during the year

■ 2024 was the last year of preparation for future growth. The board of directors developed a new strategy based on Talkpool's network services roots.

■ Underlying operational performance reached all-time highs in 2024, demonstrating the strength of core business activities. While reported margins declined year-over-year, the 2023 results included extraordinary settlements and asset sales that boosted profitability. Adjusting for these one-time items reveals that 2024 represents the company's strongest operational performance to date, providing a solid foundation for sustainable growth.

■ Continued profitable growth in Germany to EUR 4 786 thousand revenues from EUR 4 209 thousand million revenues in 2023.

■ Continued struggle in Pakistan with EUR 4 303 thousand revenues from EUR 4 512 thousand revenues in 2023. In local currency the Pakistani company grew its revenues and generated a small net profit.

■ Continued stable performance in the Swiss company with EUR 6 551 thousand revenues.

■ Continued amortization of loans, to EUR 2 083 thousand, compared to EUR 3 105 thousand on January 1, 2024, representing a reduction of EUR 1 022 thousand (33%).

■ Interest from loans reduced to EUR 116 thousand (from EUR 191 thousand in 2023).

■ Stable management and board with Magnus Sparrholm and Erik Strömstedt steering the business.

■ The consolidated equity increased to EUR 776 490 thousand after reaching positive territory of EUR 90 thousand in 2023.

Management Comments

In 2024, Talkpool strengthened its finances and developed a new strategy based on its original focus on telecom network services. Preparations for future growth were made while costs were kept to a minimum.

2024 marked the final year in Talkpool's effort to stabilize, reduce debt, and realign its business. Cash flow improved but remained strained due to debt repayments. The motto "Reduce to the MAX" does not only just refer to cost reducing but also to maximize potential for future growth.

Talkpool continued to streamline its operations, improving gross profit margins to 27.0% from 24.7% the previous year. While operational performance appeared unchanged in 2024 at first glance, the underlying operational profit margins improved to all-time-high levels. Extraordinary events in 2023 (mainly a settlement for the Pakistan acquisition) and more cautious accounting practices affected the 2024 financial results.

Global challenges, such as continued Russian aggression and political turmoil, intensified. Talkpool's business remained resilient and stable despite these multiple global challenges.

Talkpool has built numerous communication networks across all continents during the past 25 years. The company intends to improve these networks and the underlying infrastructure by using smart technology developed by partner companies.

2025: Starting growth

After years of improving efficiency, selling assets, cutting costs, and streamlining the business, Talkpool entered a growth phase in 2025. Talkpool exhibited at several trade shows and initiated a search for technology solutions that can fuel future growth.

Talkpool started 2025 with strong interim financial results. Growth reached 6.4% year-on-year (vs. Q1 2024) with EUR 4.2 million in revenues, 29.7% gross margin, 14.7% EBITDA margin, and 8.1% earnings after tax (EAT) in the first quarter of 2025.

Long-term 2030 targets of EUR 40 million revenues and 14% EBITDA were published along with a vision centered around using technology powered by artificial intelligence.

The Pakistani business continued to report poor financial results in early 2025 but signed new orders in Q2 2025 that are expected to bring growth and profitability from the second half of the year. This represents the first positive news from Pakistan in many years.

The weakening of the US dollar by 11% and PKR by 14% in the first half of 2025 is reducing Talkpool's revenues that are reported in EUR.

The parent company Talkpool AG underwent an extraordinary audit from April to August 2025 whereby the valuation of the German company was increased based on an independent valuation by BDO of EUR 20.5 million to compensate for a reduction in valuation of the Pakistani asset. This audit exercise resulted in a strengthened balance sheet, but also approximately EUR 1.5 million in losses and approximately EUR 50 000 in additional audit costs.

It will not be possible for Talkpool to pay dividends to its shareholders due to COVID loan covenants and financial constraints of the parent company.

The first phase of an options scheme was successful. The share options increased 50-fold in value as the share price increased from EUR 0.45 in March 2024 to EUR 1.25 in mid-2025. The overall options scheme runs until 2031.

Talkpool's business in the Caribbean continues to perform well. Several opportunities for generating new revenue streams have emerged in the Americas.

The German business continues to perform well but at a reduced growth rate. German management is working to increase revenue streams from new clients.

The current mid-size business is tightly controlled and highly focused on cash flow generation. The company is shifting from repaying loans to fuelling growth. The benefits for shareholders, clients, and staff have become visible.

Financial Information

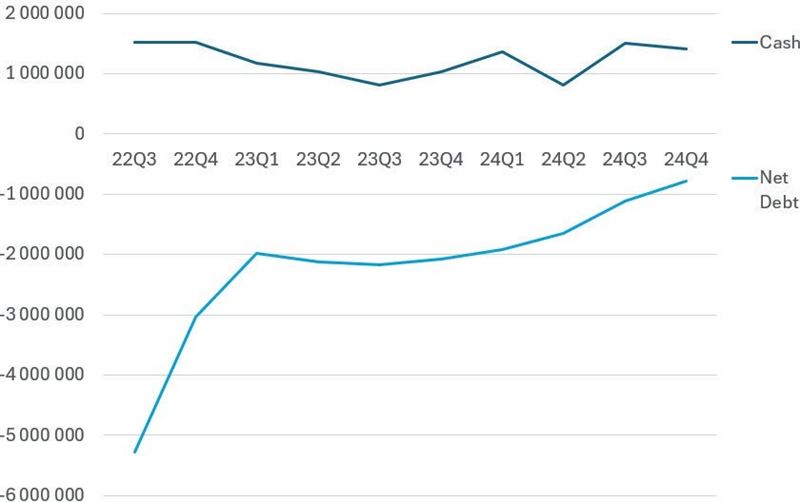

Total debt 2022 Q3 - 2024 Q4 (EUR)

Net debt decreased to EUR 0.79 million by the end of 2024. The cash improved slightly to EUR 1.41 million despite repaying EUR 0.91 million debt in 2024.

The extraordinary impact in 2024 was EUR 101 thousand. This is lower than EUR 116 thousand in 2023 and EUR 1 816 thousand in 2022. There was almost no impact on the income statement from extraordinary events in 2024.

Talkpool Group reduced and strengthened its consolidated balance sheet:

■ Overall balance (total assets = total liabilities + equity) shrunk to EUR 5 654 thousand, down from EUR 6 242 thousand a year ago

■ Equity reached EUR 776 490 thousand, up from EUR 90 thousand a year earlier.

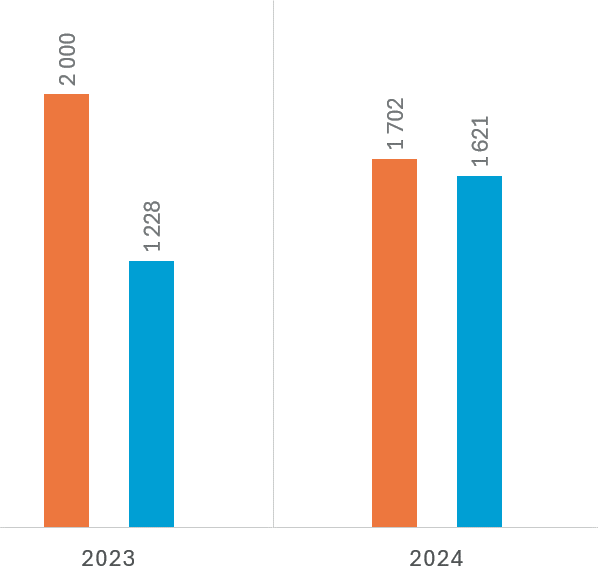

EBITDA 2022 - 2024 (EUR)

The underlaying operational business improved in 2024.

The adjusted EBITDA increased to EUR 1.6 million from 1.2 million despite more conservative accounting practices.

The Gross Margin increased to 27.0%

(EUR 4.3 million) in 2024, from 24.6%

(EUR 3.8 million) in 2023.

The complete annual report will be made available on: https://talkpool.com/financial-reports/#investor

For more information, please contact:

Magnus Sparrholm, Interim CEO

Telephone: +41 79 758 15 48

magnus.sparrholm@talkpool.com

Erika Loretz, Group Reporting

Telephone: +41 79 333 59 71

erika.loretz@talkpool.com

Talkpool provides telecommunication network services in several markets in Europe, North America and Asia. The network services are underpinned by internet technology. See www.talkpool.com for more information.

Certified Advisor: G&W Fondkommission